DBK’s J Factory Performance Report

Number of words: 3918

EXECUTIVE SUMMARY

This report aims to analyse the current situation of DBK’s factory J in Thailand with the purpose of understanding the internal and external factors that are affecting the performance of the factory and its profitability, as well as to provide with ideas for future improvement. Standard, actual and flexed budgets have been created and compared along with variances to help the purpose of this document.

SECTION 1 – Standard Costing & Variance Analysis

1.1 Preparation of a flexed standard costing profit statement and actual profit statement for December.

The standard costing method is a traditional cost accounting approach that emphasizes the variance between the actual costs and the standard costs assigned to the direct labour, direct material and manufacturing overheads. A standard corresponds to a predetermined or planned outcome that managers expect to correspond to the actual results; it is a measure of what it is expected to be achieved under the current or anticipated circumstances. [1] The flexed data is calculated by applying the standard costing figures to the actual volume output (in this case, 136,000 pairs of footwear).

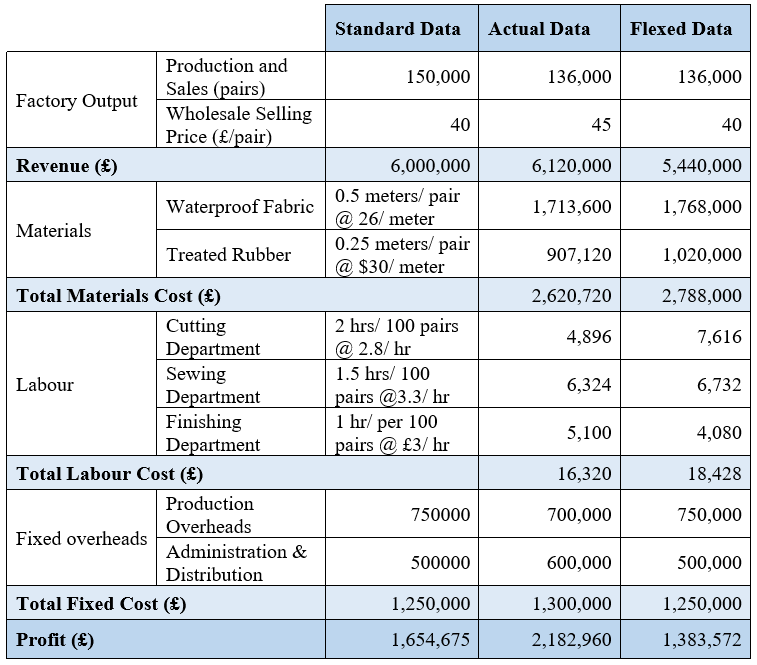

Table 1 – Flexed Standard Costing & Actual Costing Statements for December

1.2 Calculation of variances for December: price and usage variances for the direct materials (waterproof fabric & treated rubber) and direct labour rate and efficiency variances for the Cutting, Sewing and Finishing Departments.

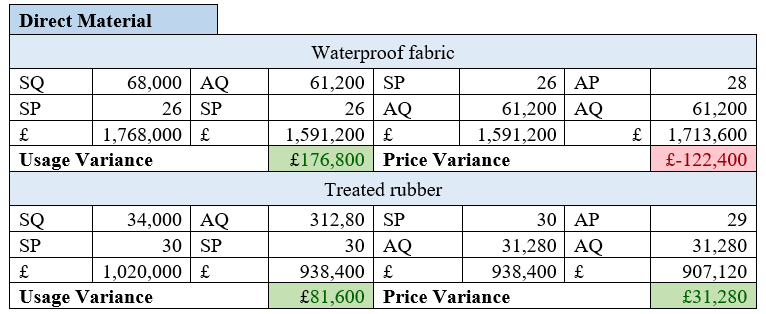

Table 2 – Usage and Price Variances of Direct Material

SQ – Standard Quantity (pairs), SP – Standard Price (£), AQ – Actual Quantity (pairs), AP – Actual Price (£)

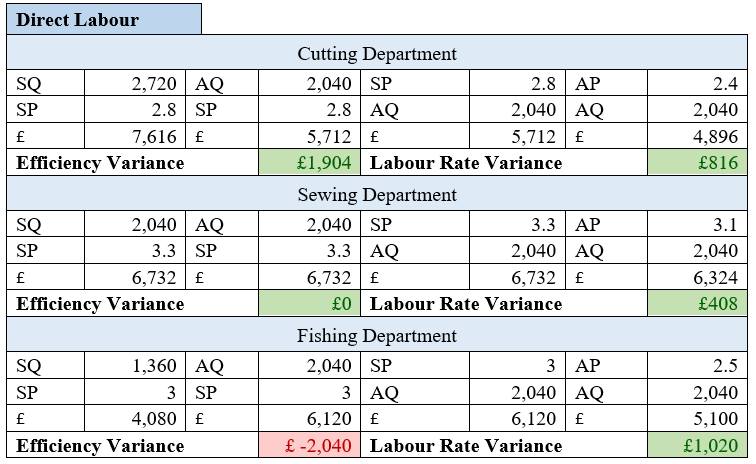

Table 3 – Efficiency and Labour Rate Variances of Direct Labour

The variances are calculated based on the following formulas:

- Usage or Efficiency Variance = (SQ*SP) – (AQ*SP)

- Price or Labour Rate Variance = (SP*AQ) – (AP*AQ).

SECTION 2 – Factors affecting the profitability of DBK’s factory

2.1. Internal and external factors which have an important influence on the profitability of the DBK Company – explained with SWOT analysis.

DBK chose to set up the factory in Thailand in order to obtain a positional advantage over their competitors by considerably reducing the costs of producing their new model of trainers in order to increase their level of output by selling them at a cheaper price in other countries.

However, given the current circumstances, it is very unlikely that the company will accomplish these objectives without applying important changes on their daily operational activities.

The main problems that the company is currently facing are the following:

- The government seems to be planning an investigation on the mysterious disease that some of the workers in the factory are allegedly contracting.

- Industrial action is an imminent threat as workers are reportedly not happy with the current wages.

- The BBC is planning on airing a documentary about workers exploitation featuring scenes secretly filmed in the factory.

- General costs are expected to increase in the near future due to a raise of the national minimum wage.

The difficulties listed above will negatively affect the company’s profitability on many levels as the reputation of the factory worsens. SWOT analysis has been used to list the external and internal problems that the current circumstances may create.

Internally, these problems may impact the company’s profitability as follows:

- Financial issues: Keeping workers unhappy with low wages is making it difficult for the company to reach production targets (the staff have found ways of expressing their frustration) – and if industrial action takes place, the factory could potentially stop production for some time, which would obviously halt sales altogether.

- Management: The factory was set up in Thailand precisely to reduce overall costs, which is the main feature providing the company with strategic advantage over its competitors. However, certain positions in management are expecting to gain a salary raise even though wages have been squeezed to a minimum and despite of the fact that the factory is underperforming as it is. This is an agency problem that will potentially lead to conflict of interests between employees and bad decisions will likely be made.

- Product quality: Keeping workers unhappy and unmotivated will potentially lead to a reduction of product quality, leading to high rates of external and internal failure and therefore increasing costs for the factory, reducing overall profit for the firm.

- Attitude and behaviour: Certain employees are being particularly problematic for the factory. It is believed that they let the BBC enter the factory and they even brought their children and made them do work so they would be filmed by the hidden camera. This means that employees are being influenced by this toxic behaviour, potentially making a habit out of it. This will negatively affect productivity and, therefore, profitability in the long run.

Externally, factors to take into consideration are the following:

- Political/legal: The government’s investigation about the disease and the BBC documentary will most likely affect the company’s reputation, which would lead to negative international perception of the firm. It is natural to expect sales being badly hit by this phenomenon, preventing the company from reaching their sales targets and therefore, reducing revenue and profit levels.

- Economic environment: The government is planning on raising the national minimum wage in the near future, which will unavoidably make general production costs to increase – potentially cancelling the competitive advantage that the company was initially seeking.

- Competitors: Once the company has been severely affected by the negative impact of the current situation, it is common sense to expect competitors to take over DBK’s market share that this new product would be covering, potentially making it very difficult for the company to re-enter this customer segment.

- Customers: Customers may be deterred from purchasing DBK products due to its bad reputation and may choose to buy products from competitors, reducing customer loyalty and goodwill.

- Suppliers: Given the circumstances, suppliers might not want to be related to DBK in any ways whatsoever to avoid their reputation being stained, which could mean that they would stop selling materials to the firm, exacerbating the scenario even further. Suppliers may find ways of obtaining deals with DBK’s competitors instead.

- Investors: The firm entering financial difficulties would mean that DBK would not be able to return money to shareholders, which at the same time would prevent future investors from investing in the company.

2.2. Gathering information for measurement, control and improvement purposes by the management accountant.

Management accounting exists to help create organisational value using better decision making and management of the members of an organisation [2]. Therefore, the manager accountant should be able to gather information that measures the extent at which all aforementioned factors affect the firm for the purpose of developing better management strategies that create value for DBK and thus, their customers – which will in turn boost profitability for the organisation.

The factory set its own production and financial targets. Comparing the standard budget created at the start of the period with actual numbers would provide the manager accountant with valuable information about whether those targets are being met. Noticing that the factory is underperforming is a window to detecting problems and start thinking about possible solutions for these. Therefore, frequently checking budgets and calculating variances is essential to find information about current performance. Budgeting is useful for implementing change in the company in response to changes in its environment and to implement appropriate tools for planning and control [3].

Once the main problems that affect performance have been detected, further investigation can be carried out by using a balanced score card [4]. This could be used as a template to find the weakest points of the factory and also as a template to figure out possible solutions taking into consideration how these will contribute to the general performance of the factory.

Given the current situation, the balance score card could have the following vision and strategy:

Internal business processes:

- Objectives: To get an agreement with employees in order to avoid industrial action and to meet production targets.

- Measures: To arrange a meeting with all the employees of the factory to discuss possible solutions to the existing problems at the operational level.

- Targets: To implement a commission reward system based on targets to promote productivity and to complement staff wages.

- Initiatives: Make workers understand that both parties (staff and the firm) need to compromise in order to keep the factory running. Convince them that a target-based commission reward is the way to go.

Financials:

- Objectives: To reach overall expected sales and profit levels.

- Measures: To control the impact of current external factors on the factory and firm’s reputation.

- Targets: To minimise the impact of these external factors as much as possible – ideally, completely neutralise the impact.

- Initiatives: Arrange a meeting with the BBC so the factory manager can make an appearance in the documentary in order to soothe the impact (possibly, bringing the BBC into the factory again and give them a proper tour explaining that the claims made by the workers are false), arrange a meeting with the city mayor and make him understand that there is no evidence to support the rumour of the existence of a mysterious disease being contracted by workers.

Learning and Growth:

- Objectives: To implement measures that will prevent the factory from falling into the same problems again in the future.

- Targets: To keep a smooth production flow in the factory while avoiding major problems.

- Initiatives: Annually review wages, implement behavioural control systems and clan controls [5], eliminate contra productive behaviour and agency problems in order to neutralise conflict of interests to have all employees working towards the same goals – managers will also get a commission based on sales targets to promote goal congruence within the factory (the manager accountant would focus on sales and expansion rather than reducing costs to the point of underperformance. There needs to be a cost-profit balance when establishing commissions and bonuses. Stock options would also be a good initiative to accomplish this).

Customer:

- Objectives: To provide quality and value for customers in order to promote good reputation of the firm and to build strong customer loyalty and goodwill.

- Measures: To promote W-trek trainers and to build good reputation.

- Targets: To soothe further the possible impact of adverse external factors and to reach targeted sales.

- Initiatives: To launch a marketing strategy covering the main media formats to obtain high visibility and awareness of the new product by potential customers.

By reflecting the main difficulties that the factory is going through on a balance score card, the manager accountant would be able to gather information about current problems and easily start thinking about solutions that not only can solve those problems but also contribute positively to the overall picture. This double-fold feature of the balance score card makes it very useful for these types of problematic environments that require a quick reaction to bounce back. The appendix at the end of this document shows how the situation could be analysed with one more analytical tool.

SECTION 3 – Types of Standards & Budget Planning

3.1. Distinction between basic, ideal and attainable standards and explanation of how these may be used at the factory.

- Types of Standards

Basic

The basic standard is built for the long-run and remains constant for a long period of time (remains the same for many years). In general, basic standards are more adequate for monitoring operating performance over time such as variation trends in prices and efficiency rather than for control purposes. As they are not updated according to the latest changes, they are not helpful to analyse variances in short term periods.

Ideal

The ideal (or theoretical) standard can only be achieved under perfect operating conditions, i.e., maximum output at minimum cost. Therefore, there is no space for inefficiency and normal losses such as material waste, machine breakdown, maintenance or idle hours. It is not an achievable standard on a long run and, thus, it has no or little use for control purposes.

Attainable

The attainable (or expected) standard represents achievable targets under normal operating conditions and with a realistic level of effort input. It includes allowance for normal losses, machine breakdowns, maintenance and idle time. As attainable standards contain realistic and attainable targets, they are used for control purposes and helps to increase employees’ motivation.

Current

The current standard is used to evaluate the level of attainment that is being currently achieved under the current business conditions. Therefore, it is relevant for a short-term control analysis but has no incentive to improve the current level of performance.

- Standard Type Selection

The selection of the type of standard to be applied is relative, based on specific situations. The stability of the involving economic environment and the availability of resources and company’s capacity to face challenges are some of the aspects to be considered for the standard type selection.

According to the case study, J factory of the DBK Company is facing many challenges recently both resulting from internal (dissatisfaction of its employees, workers illness, machine breakdowns) and external factors (level up of country’s national minimum wages), as mentioned in section 2.1. Therefore, the budget for the next coming financial period should not be built based on basic or ideal standards as those may result, for example, on a deeper negative effect on employee’s motivation.

The selection of an attainable standard based budget will be the appropriate approach as it eases the factory’s level of output and provides some margin of freedom to the employees to reach their targets, therefore increasing their performance and motivation. Additionally, having a closer control over the factor, both the expectation on the factory output and manager’s reputation could get a boost.

The current standards presented for the month of December will be helpful for the building of the attainable budget for the next financial period.

3.2.Procedure to be followed by the management accountant in formulating the budget for J factory for the financial period and a discussion on whether revision of budgets already established is necessary.

- Budgeting Process

When creating the budget, the management accountant must align J factory’s objectives with DBK’s overall strategic plan taking into consideration the conditions and restrains that the factory is currently facing. Therefore, during the development of the budget, it is important to consider the following steps that are generally used by management accountants to produce an adequate budget:

- To determine the budget period (usually monthly, quarterly or annually).

- To Identify limiting factors – any factors that may limit the activity of the organisation.

- To prepare functional budgets such as production, sales, direct material, direct labour and administration expenses.

- To prepare and review the master budget.

- To obtain the approval from top management and then announce the master budget.

As internal and external changes occur frequently, budgets are reviewed constantly for potential changes.

- Decision on J factory’s budget revision

Based on the actual results from December, the constant threat coming from the factory’s employees and the overall climate in the country related to the employee’s working conditions and salaries, the management accountant should follow the production manager advice when reviewing the budget.

One of the main problems at the J factory is the unsatisfaction of workers, which has already impacted the factory. For instance, false claims, machinery breakdowns and longer leaves of absence are common ways in which employees are trying to harm the company. In order to ameliorate this situation, labour rates can be adjusted according to their productivity (production target-based bonus). This approach would be beneficial both for the factory and the employees as the quality and outcome of their performance will lead to a higher production efficiency and a boost employees’ motivation.

Moreover, Thailand’s government is preparing an increase in the national minimum wage, obviously leading to an increase raw material costs and consequently, the budget needs to be reviewed accordingly. The budget needs to be planned taking into consideration that standard costs of the waterproof fabric and treated rubber will unavoidably increase.

SECTION 4 – Reconciliation of Statements & Variances Discussion

4.1. Statement reconciling actual profit with flexed standard profit figures.

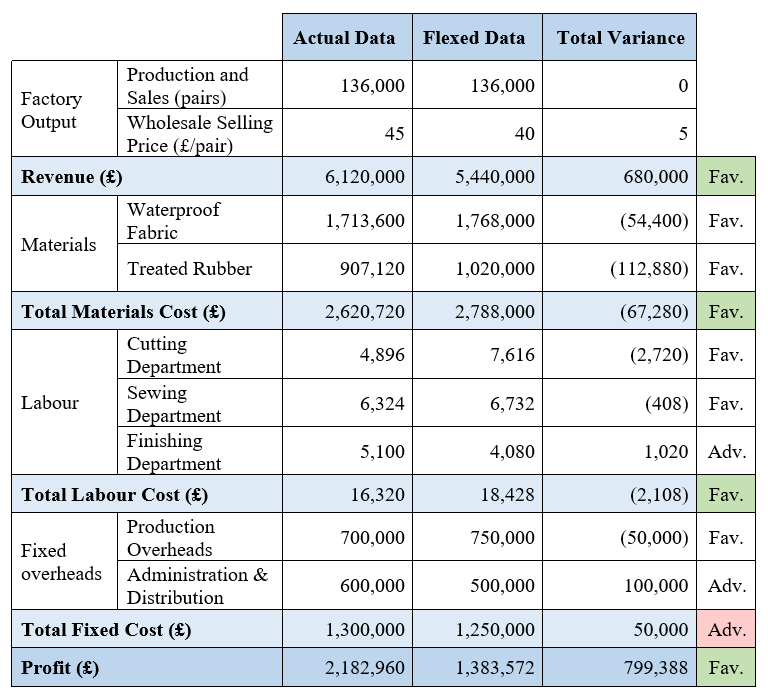

Table 4 – Total Variance between Actual and Flexed Data

Adv. – Adverse, Fav. – Favourable

The total variances correspond to the difference between the actual data and the flexed standard data. Total material variance and total labour variance can be similarly obtained by adding the respective partial variances (tables 2 and 3), for example, Total Material Variance = Material Usage Variance + Material Price Variance.

4.2. Possible causes for the variances calculated in section 1.2.

Achieving planned profits depends on management’s ability to control sales and costs.

The waterproof fabric price variance is adverse (table 2). This is probably because the market price of waterproof fabric is higher than earlier on, or the purchase size shrank leading to lower discounts applied by providers. Usage variance is favourable, possibly due to high efficiency when using materials, effective staff supervision, or less waste due to lower levels of scrap product in the manufacturing process.

The treated rubber price variance is favourable (table 2), as its unit price has decreased by 1 pound. Efficiency on purchasing amounts may be the cause. Good purchasing strategies or a strong bargaining power may be helping J factory to reduce purchasing costs. The same applies to the usage variance and waterproof fabric. Potentially, there may be some other reasons for these favourable variances, like efficiency in the use of machinery in manufacturing processes and/or further training of employees that could have taught them how to improve general efficiency when carrying out daily operational procedures.

The cutting department has favourable direct labour and efficiency variances (table 3). This can be a result of the pressure from DBK’s production director on J factory’s manager to reject the demand for higher wages. Additionally, the good quality of the machinery or the high level of labour training may be reasonable explanations for the positive efficiency variance.

Direct labour variance is favourable in the sewing department without efficiency variance (table 3). The reason is similar with cutting department, workers need to receive higher wages as an award because they may work over the normal time. The efficiency variance is zero possibly because the actual situation is perfectly conformed with expectations.

Similarly, the finishing department presents a favourable direct labour rate variance but an adverse efficiency variance (table 3). Comparable reasons from other production departments may have led to this favourable labour rate variance. On the other hand, the negative efficiency variance may be caused by high labour turnover, inefficient supervision or not enough labour training such as how to operate the machinery. As fixing machinery affects the time necessary to produce the output, unexperienced staff could have led to the breakdown in the quantity produced. Therefore, the quality of the machinery needs to be considered as well.

SECTION 5 – Recommendations & Conclusion

Neutralising the adverse external and internal factors is key to the long-term success of the factory and the firm. The hostility of the current environment can put the company in a difficult position – unless appropriate action is taken by managers. In order to overcome the present difficulties, it is recommended that DBK adopts the following measures:

- Make sure that the objectives of the management accountant are aligned with the objectives of the workers in the factory, so everyone works towards the main goals of the firm.

- All employees should get bonuses when achieving the production, sales and growth targets set by headquarters to promote purpose congruence.

- Adopt an activity-based budget system to keep better track of the expenses of each department for better cost control and more accurate cost allocation.

- Use clan control and train employees in a way that they all contribute positively to the context of the company.

- Proper training for workers in terms of health and safety issues, emphasising the importance of carefully handling materials with potentially hazardous chemicals. Acquiring appropriate protective equipment is also advised.

- Accept that general costs will go up and focus on sales and production efficiency rather than an aggressive reduction of costs.

- Focus on improving total quality management and customer satisfaction strategies. Total costs will increase, it is a certainty. Further investment is unavoidable. How could we improve the product, so it is better/more desirable? How would we sell more?

REFERENCES

[1] Drury, C. (2018) Management and Cost Accounting, 10th ed. Cengage Learning.

[2] Liu, Lana (Academic year 2019-2020) Managerial Decision Making and Control – Accounting, Finance and Strategic Investment postgraduate course at Newcastle University, Lectures 1 & 2.

[3] Liu, Lana (Academic year 2019-2020) Managerial Decision Making and Control – Accounting, Finance and Strategic Investment postgraduate course at Newcastle University, lectures 7, 8, 9 and 10.

[4] Liu, Lana (Academic year 2019-2020) Managerial Decision Making and Control – Accounting, Finance and Strategic Investment postgraduate course at Newcastle University, lectures 19 & 20.

[5] Liu, Lana (Academic year 2019-2020) Managerial Decision Making and Control – Accounting, Finance and Strategic Investment postgraduate course at Newcastle University, lectures 13 & 14.

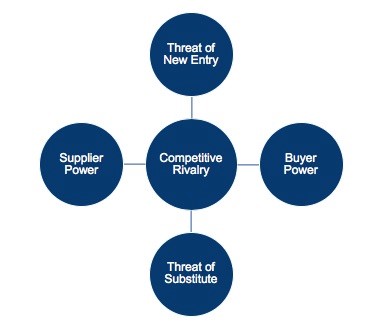

Appendix – Porter’s five forces

Porter’s 5 forces effectively explain the possible threats that the company may encounter given the current situation.

- Threat of new entrants: New competitors may find ways of acquiring DBK’s market share if cost minimisation does not work.

- Buyer power: Not being able to produce the promised product and/or having a negative international perception could place customers in the position of choosing loyalty to competitors.

- Threat of substitute: Is the W-treck waterproof feature such a key player? Would people not consider other options that suit their needs?

- Supplier power: Will providers be willing to sell to DBK given its future reputation? How is DBK sure that suppliers will change priorities on who to sell their products to?

Following the strategies mentioned in the balance score card and the recommendation section of this report would be useful to solve these problems.